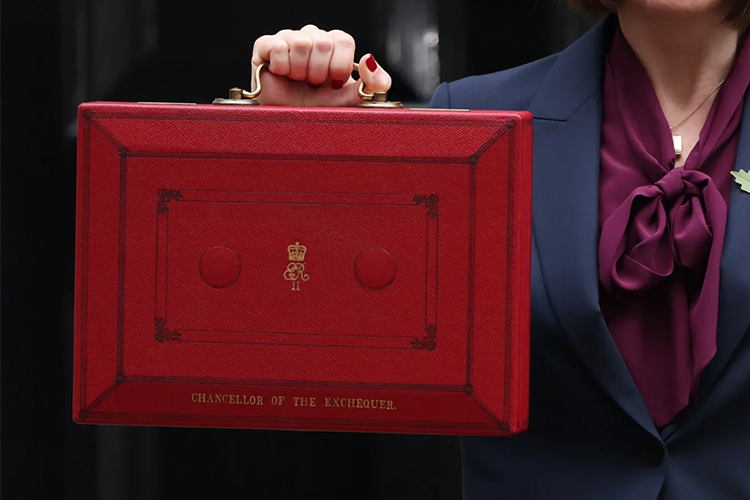

The latest Budget has laid out significant changes that will reshape the tax liabilities for investors, company directors, property owners and savers.

The Chancellor’s aim in making these changes is to narrow the gap between the tax paid on income from employment and that from assets; this has translated into increases in tax rates for income from dividends, property/rental profits, and interest on savings.

The headline change, from April 2026, is a 2% increase in the basic and higher rates of dividend tax.

These rates apply after the £500 tax free allowance for Dividends.

For owner-managed businesses, this means the tax advantage of taking profits via dividends over salary has been further eroded. If you are a director then now is the time to review your remuneration strategy.

Rental profits will now be taxed under a separate and increased set of income tax rates.

From the 2027/28 tax year, the new property income tax rates will increase by 2% across all bands.

These rates will apply specifically to property income, separate from the rates for non-savings, non-dividend income, and savings income.

In line with the aim of narrowing the gap between taxes paid on earned income and asset income, the Budget has introduced a significant increase in the tax rates applied to savings interest.

From April 2027, the following increases take place.

While the tax rates are rising, the Personal Savings Allowance (PSA) – which allows basic rate taxpayers to earn up to £1,000 in interest tax-free, and higher rate taxpayers £500 – will remain at its current level.

This means the PSA provides less protection in real terms, especially when combined with the ongoing freeze on income tax thresholds. As more people are pulled into the higher rate tax bracket, their available PSA is halved to £500, and the remaining taxable interest will be subject to the higher 42% rate from 2027.

The starting rate for savings still applies as before, if your earned income is less than £12,570 you can earn an additional £5,000 tax free from savings interest. This rate falls as your income increases up to £17,570, at which point this savings rate falls to £0.

Which all means, that for owner-managers, directors and individuals, the tax landscape has changed. If you’d like to find out the implications for your tax bill, and to chat through your options, why not contact the tax team here at Optimum?